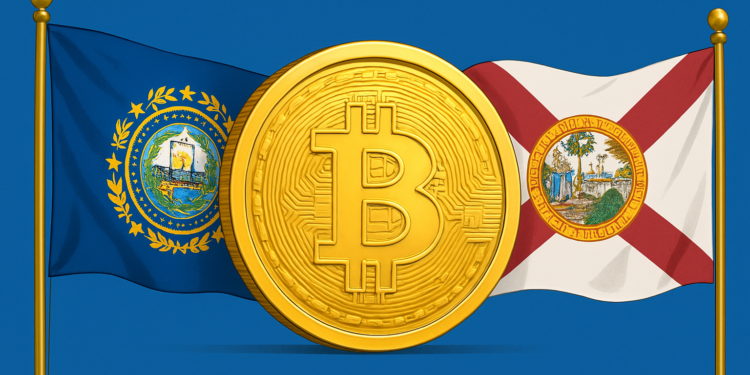

On April 10, 2025, the New Hampshire House of Representatives narrowly passed HB302 with a 192–179 vote. This significant legislation authorizes the state treasurer to allocate up to 10% of New Hampshire’s general and specified state funds into precious metals and select digital assets. According to the bill, only cryptocurrencies exceeding a $500 billion market cap, effectively limiting options to Bitcoin, qualify for this investment. The bill will now move forward for review by the state Senate.

Simultaneously, Florida’s House Insurance and Banking Committee unanimously approved HB487, signaling strong bipartisan support. This bill empowers the state’s chief financial officer and the State Board of Administration to invest as much as 10% of certain state financial pools—including the General Revenue Fund and Budget Stabilization Fund—into Bitcoin. HB487 specifies direct investment pathways, outlines necessary custody arrangements, and mandates robust security protocols. The bill still needs to clear three additional committees before it can proceed to a full vote in Florida’s House.

New Hampshire and Florida’s legislative moves align them with states like Arizona, Texas, and Oklahoma, where similar Bitcoin reserve bills are gaining traction. Notably, Arizona’s two Bitcoin-related bills, SB1373 and SB1025, have already cleared the House Rules Committee and await final voting. Should these bills pass, they would require the governor’s signature to become official state policy.

The accelerating trend among U.S. states towards adopting Bitcoin reserves highlights a broader shift towards institutional acceptance of digital currencies, potentially reshaping national strategies on financial management and digital asset investments.